As a business, one of the most important ways you can meet the needs of your customers is by offering mobile payments. Doing so is not only good for business, but it can also improve trust and your overall reputation. By using mobile payment systems, you enhance your customers’ experiences in-store, increase checkout speeds, and can keep better track of inventory. Mobile phone payments also make paying at businesses like restaurants or hotels quicker and hassle-free. If you’re looking to accept these types of payments, it’s important to understand the technology behind them. Read on to learn everything you need to know about mobile payment processing. We’ll discuss why you should include contactless phone payment processing in your daily operations.

What is a Mobile Payment?

As the name suggests, a mobile payment is a transaction that goes through a mobile device or smartphone. The transaction is similar to any other credit or debit card transaction. However, instead of swiping or inserting your card through a POS system or plugged-in terminal, you’re able to charge customers via a mobile device or app. We’ll get into the specific types of mobile payments later on.

Mobile payment systems basics

Now that you’re familiar with what mobile payments are, let’s dive into some of their basic principles.

Mobile payment systems come in a variety of forms. Their purpose is to make processing mobile transactions easier for both the merchant and the customer. Since merchants have been reluctant to give up their POS systems and archaic readers, this type of refusal has led to a slower growth for mobile payment processing. Therefore, accepting mobile payments places you steps ahead of your competitors.

Generally speaking, there are a few different types of payment processing that constitute mobile processing. These can include:

- Mobile terminals/readers

- Phone readers and text invoicing

- Mobile wallets/apps

- QR codes

- Virtual terminals

How does mobile payment work, exactly?

As mentioned above, mobile payment systems come in many shapes and forms. However, generally speaking, mobile payments work using NFC technology. NFC or Near Field Communication enables the processing of these payments through small waves, like Bluetooth.

When a terminal processes mobile payments, it does not need a manual link to use NFC technology for transferring data. The customer opens their mobile wallet and holds the phone about two inches from an NFC terminal. The digital wallet appears and asks for payment confirmation. Once a customer opens the mobile wallet and verifies the payment, it processes in an instant. All the latest iPhones come with NFC technology built-in.

Other mobile payment systems such as text invoicing, QR codes, and virtual terminals depend on technology that either brings the customer to a payment form or has them input their banking information via a gateway ID. These methods work through a business’s merchant account directly.

Mobile Payment Options

You can use one of several options to process mobile payments. A business can use the following payment types when signing up for a mobile payment service.

NFC payments

Near Field Communication technology commonly supports mobile wallets and contactless payment processing. This form of mobile technology allows two devices to communicate wirelessly. In this case, the vendor and customer use a card reader and mobile phone, respectively. An NFC chip enables both devices to communicate.

Mobile wallet

Used as a smart device app, a mobile wallet stores the customer’s debit or credit card information so they can pay with their mobile device. Some of the popular mobile wallets include Google Pay, Samsung Pay, and Apple Pay.

The user downloads the mobile wallet app on their device before adding their card details. Tokenization allows for added security of sensitive card data. This process exchanges the 16-digit number on a credit card with an alphanumeric ID or a token.

To make a mobile payment, the user positions their phone near a POS system or card reader in-store. The use of NFC technology enables the user to pay this way without using a credit or debit card.

QR codes

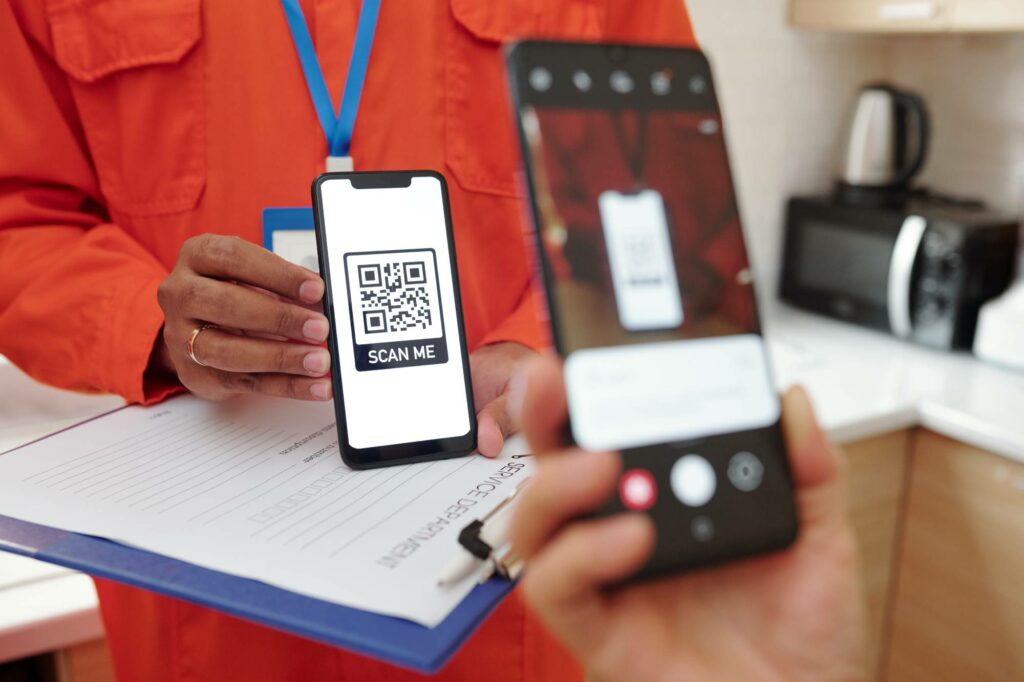

The acronym QR stands for Quick Response, a type of code technology sometimes used for mobile payment processing.

Using a QR code is perhaps the best way to send payments in modern times. When a merchant or user scans the code, the software on the phone decodes the horizontal and vertical matrix. When this happens, the code is translated into a string of characters captured by the phone’s camera. After the data processes, the phone opens a browser link to verify the phone payment details or confirm the geolocation.

Customers can also make QR code payments through app-to-app functions.

Text to Pay

Text to pay or SMS payments make mobile payment processing super easy. These work in the following ways:

- The customer accesses a web page to retrieve a code and sends the code to a text number displayed on the site. A text verifies the payment succeeded and then provides access to the paid service or product.

- The user enters their mobile phone number onto a website. The SMS payment provider, in response, texts the number with a code. The payer uses the texted code to access content online.

- The user, in this case, sends a text to a specific number before the payment is verified.

In each of the above scenarios, a customer transmits a premium SMS, which includes the cost for a service or product they purchased. The money is subtracted from a prepaid mobile phone or included on a user’s mobile phone payment invoice.

When operators make these payments, they take part of the SMS premium price as a fee before sending the balance to the SMS payment processor. The processor runs the SMS payment gateway for the merchant.

3 Reasons to Adopt Mobile Payment Services

As you’ve seen, these payment services come with great value. Specifically, adopting a mobile payment system offers three main benefits.

1. Convenience

Customers do not have to search in their purses or wallets for cash, or try to scramble and look for credit cards. They can easily tap their app and make payments effortlessly.

In many cases, your mobile device transforms into a POS system, ready to accept customer payments anywhere you are. Not only does this increase the number of transactions, but it also facilitates the checkout process for your customers. Just think about all the counter space you can save when you ditch your clunky credit card terminal.

2. Efficiency

Using a mobile payment system enables a merchant to streamline operations. This quick and easy payment form leads to shorter checkout lines, saving time and money. That way, you can get back to doing what you enjoy most, running your business.

3. Security

Innovations like QR codes enable users to take advantage of advanced encryption. This makes this form of payment more safe and secure. In addition, the customer does not have to pay with cash, which also increases security.

How Mobile Payments Can Work for Your Business

Mobile phone payment processing allows you to increase your revenue, improve the in-store or online experience for your customers, and gives you an edge when monitoring your inventory. In return, you will have happier customers, a better cash flow, and more streamlined operations.

Leave a Reply